|

Tax Efficient Strategies

Maximize Wealth, Minimize Taxes

|

What Are Tax Efficient Strategies?

Smart Financial Moves to Save More

Taxes can erode your wealth if not managed properly. At Gibson Capital, we don’t let the tax tail wag the dog, however we do keep in mind strategic tax planning tailored to your financial goals.

Tax-Smart Planning for Your Future

Examples of some tax strategies

01

Roth Conversions

A Roth Conversion involves moving funds from a pre-tax retirement account into a Roth IRA. While you’ll pay taxes on the converted amount in the year of the conversion, future growth and withdrawals from the Roth IRA are tax-free, provided certain conditions are met.

02

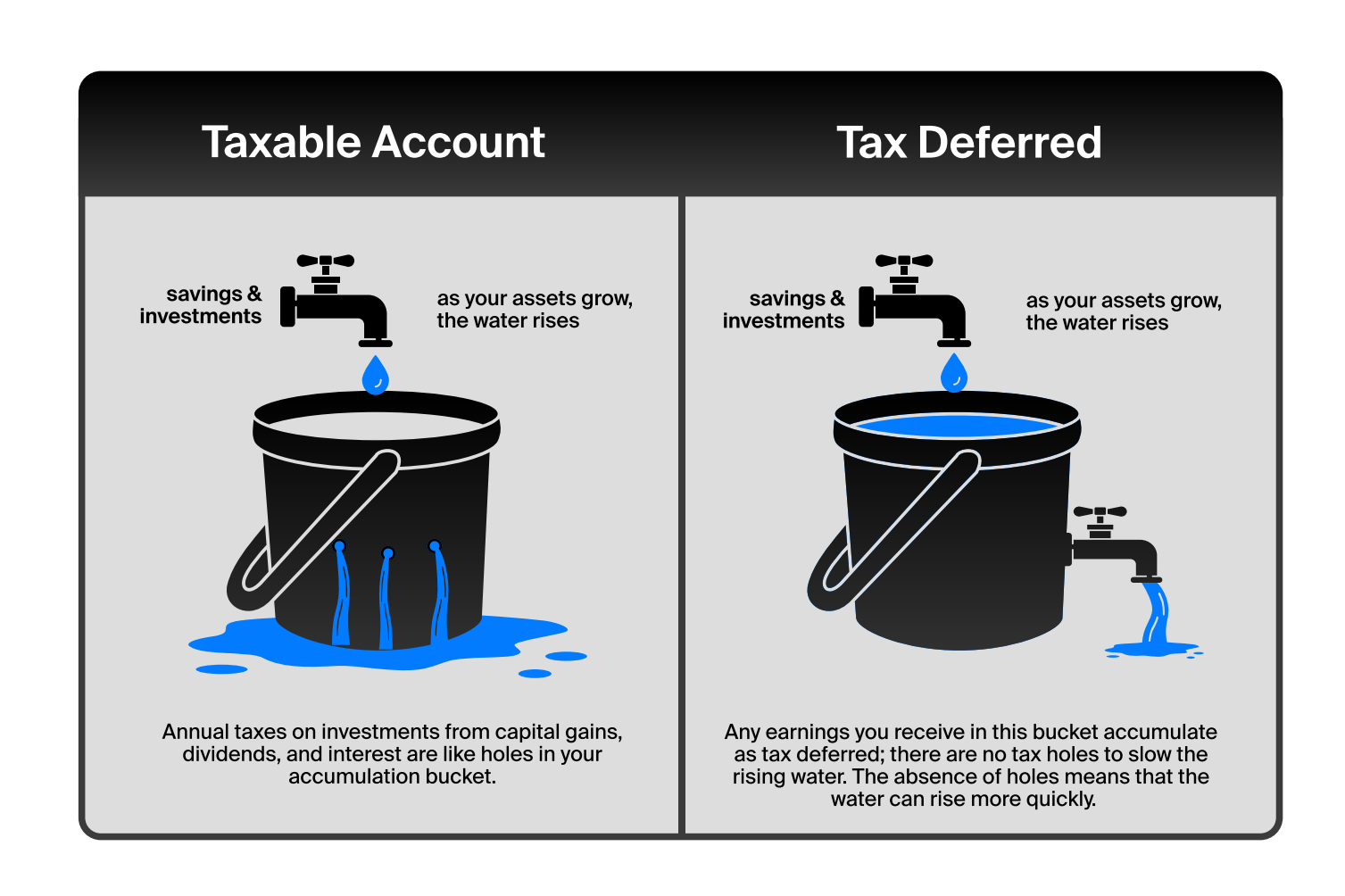

Tax Deferral

Triple compound Interest uses tax deferral on principal, interest and taxes saves. Instead of taxes paying each year, the funds grow without interruption from annual tax liabilities. Taxes are paid when the funds are accessed. Tax Deferral allows your account to grow faster by keeping the full amount invested and compounding over time.

03

IRMAA Savings

This is the silent killer. For retirees on Medicare, the Income-Related Monthly Adjustment Amount (IRMAA) can significantly increase Medicare Part B and Part D premiums if income exceeds certain thresholds. Strategic planning, such as controlling when and how you realize income from investments or retirement accounts, can help manage your income levels. This can reduce or avoid IRMAA surcharges, potentially saving tens of thousands of dollars, if not hundreds of thousands over your retirement years.

04

Keeping More in the Family: Tax Efficient Wealth Transfer Planning

Passing assets to the next generation isn't just about having a will or a trust, it's about understanding a maze of rules and deadlines that most people never deal with until it's too late. Complex legislation like the SECURE Act 2.0 has changed the way inherited accounts work, and there are many blind spots that can cost your family time and money. The right advice can help you see what's coming, avoid costly mistakes, lower your beneficiaries' taxes, and make sure more of what you've built ends up in the hands of the people you care about. As I work with my tax expert, Heather Schrieber, we can help you create a plan you can feel confident about for today and generations to come.

Your Questions, Answered

What are Tax Efficient Strategies?

These strategies can reduce the amount of taxes you pay on your income, investments, and savings, maximizing your wealth.

Are tax-efficient strategies only for high-income earners?

No, anyone can benefit from tax-efficient planning regardless of income level.

How often should my tax strategy be reviewed?

We recommend annual reviews or whenever there are significant changes in your financial situation.

Are you a tax expert?

No. CPAs are tax experts. We recommend you also work closely with your accountant.

Preserve More of Your Wealth

Let us create a personalized tax-efficient strategy to help you keep more of what you earn. Schedule a consultation today to start optimizing your financial plan.